A total of 21 vulture funds, investment funds taking advantage of economically distressed entities – submitted to federal court more complete information about their investments in Puerto Rico’s central government bonds. In what can be considered a small but positive step in a process characterized by its lack of transparency and in-the-dark negotiations, these documents shed some light on the strategies used by these funds.1

The financial disclosures contain information on the investments of the vulture funds from January 2019 to June 2020 that until now had been inaccessible. They were filed following a May 26 order by Judge Laura Taylor Swain, requesting greater accuracy in their disclosures.

The new financial disclosures come in the context of negotiations between the vulture funds and the oversight board. The vulture funds are seeking to extract the greatest amount of profits from Puerto Rico, to the detriment of the future of the country. To achieve this, they need to approve the central government’s plan of adjustment, the last step to restructure around $35 billion in debt from the government and several of its corporations. Before the coronavirus pandemic, the oversight board was on the offensive. Last February it filed its second version of the plan of adjustment that, among other things, imposed cuts to the pensions of over 65,000 retirees.

The COVID-19 pandemic ruined the agreement that was reached.

The new disclosures clarify distinctions about the nature of the debt that were previously unknown. First, they distinguish between general obligation bonds and Public Buildings Authority bonds. Previously, these bonds were identified as “constitutional debt”, despite coming from different issuers. More importantly, disclosures identify the bonds by their series, which implies that we can distinguish now between bonds whose legality has been challenged and those who have not been challenged by the oversight board. This differentiation is key to understanding the course of the negotiations.

The prices of all these bonds have had a different evolution in the market, so their clear identification is essential.2

From the analysis of the data provided in these disclosures, and from the examination of other documents related to the bankruptcy proceedings, we have found:

- The 21 vulture funds that make up the four coalitions that negotiate with the oversight board have $7.7 billion in central government bonds. This represents around 42% of the central government bonds to be restructured in the plan of adjustment.

- Taking advantage of the drop in prices as a consequence of the COVID-19 pandemic, at least four funds acquired over $443 million in central government bonds.

- The Lawful Constitutional Debt Coalition supported the oversight board in its challenge to the central government bonds issued after 2012. However, four vulture funds from this coalition – GoldenTree, Monarch, Taconic, and Whitebox- bought bonds on the market whose legality they themselves were challenging in court. Thus, these investors were placed on both sides of the legal dispute.

- There have been complaints of insider trading, the use of non-public information to buy and sell bonds while the negotiations were taking place. In this report, we examine these allegations in light of the evolution of bond prices. Insider trading is an illegal practice punished by federal law.

In this report, when we talk about central government bonds, we mean the sum of the general obligation bonds and the bonds of the Public Buildings Authority.

Increasing their investments, taking advantage of the coronavirus

Most of the vulture funds that negotiate with the oversight board over the portion of the central government’s General Fund they will receive are organized in four coalitions. Each coalition shares the same lawyers and the same legal strategy.

| Coalition | Current Members | Formation | Attorneys |

| Ad Hoc Group of General Obligation Bondholders | Autonomy Capital Aurelius Capital | July 2015 | Paul, Weiss Robbins, Russell Willkie Farr & Gallagher Jiménez, Graffam & Lausell |

| QTCB Noteholders Group | Canyon Capital Advisors Davidson Kempner Capital Sculptor Capital | August 2015 | Morgan, Lewis & Bockius Correa-Acevedo & Abesada Law Offices |

| Ad Hoc Group of Constitutional Debtholders | BlackRock Financial Management Brigade Capital Management Brookfield Asset Management Emso Asset Management First Pacific Advisors Mason Capital Management Silver Point Capital VR Advisory Services | August 2018 | Morrison & Foerster G.Carlo Altieri Law Offices |

| Lawful Constitutional Debt Coalition | GoldenTree Asset Management Whitebox Advisors Taconic Capital Advisors Farmstead Capital Management Aristeia Capital Marble Ridge Capital FCO Advisors Monarch Alternative Capital | February 2019 | Quinn Emanuel Reichard & Escalera |

It should be noted that six of these funds – GoldenTree, Whitebox, Taconic, Aristeia, Canyon, and Monarch – were part of the COFINA plan of adjustment. The first five were in the same group during the COFINA negotiations, where they were represented by law firms Quinn Emanuel and Reichard & Escalera.3 These firms now represent the Lawful Constitutional Debt Coalition in negotiations with the oversight board.

From January 2019 to June 2020 the vulture funds increased their investments in bonds from $5 billion to $7.7 billion, an increase of 53%. The following table shows how the four coalitions have continued their bond purchases.

Investments in Central Government Bonds

| Coalition | January/February 2019 | June 2020 | Increase/Decrease | % |

| Ad Hoc Group of General Obligation Bondholders | $1,396,094,960 | $1,090,708,937 | -$305,386,023 | -22% |

| QTCB Noteholders Group | $1,507,590,645 | $1,932,534,920 | $424,944,275 | 28% |

| Ad Hoc Group of Constitutional Debtholders | $1,408,868,000 | $2,737,181,370 | $1,328,313,370 | 94% |

| Lawful Constitutional Debt Coalition | $763,090,000 | $2,010,054,449 | $1,246,964,449 | 163% |

| Total | $5,075,643,605 | $7,770,479,676 | $2,694,836,071 | 53% |

The debt to be restructured by the plan of adjustment amounts to around $35 billion. Around $18.4 billion consists of bonds from the central government.4 Vulture funds held $7.7 billion in June, which amounts to 42% of the central government’s bonded debt.

The COVID-19 pandemic shook global financial markets. In the United States, during February, the New York Stock Exchange crashed. In the case of Puerto Rico, the effect of the pandemic began to impact the bond market during the first week of March. An examination of central government bond prices shows that between March and May the prices of some bonds fell between 25% and 42%.5

The Ad Hoc Group of Constitutional Debtholders stood out for being the coalition that acquired the most bonds since the beginning of the curfew and the closure of businesses ordered by Governor Wanda Vázquez on March 15. While the country was undergoing one of the strictest quarantines in the entire United States, this group purchased around $377 million of central government bonds between March 10 and June 24 at cheaper prices, as a result of the pandemic.

Four funds stand out above the rest: BlackRock, Emso, Silver Point, and Aristeia.

Investments in Central Government Bonds During the COVID-19 Pandemic

| Fund | Coalition | March 2020 | June 2020 | Increase | % |

| BlackRock | Ad Hoc Group of Constitutional Debtholders | $394,238,000 | $479,567,243 | $85,329,243 | 22% |

| Emso Asset Management | Ad Hoc Group of Constitutional Debtholders | $545,320,000 | $663,095,000 | $117,775,000 | 22% |

| Silver Point | Ad Hoc Group of Constitutional Debtholders | $102,985,000 | $286,289,452 | $183,304,452 | 178% |

| Aristeia | Lawful Constitutional Debt Coalition | $265,970,00 | $322,695,000 | $56,725,000 | 21% |

Playing on both sides: Challenge the bonds, then buy them at lower prices

On January 14, 2019, one of the most surprising legal actions in the bankruptcy process was filed in court. The oversight board challenged the legality of over $6 billion in general obligation bonds issued between 2012-2014 for allegedly exceeding the debt limit established in Puerto Rico’s constitution.7 This legal action has determined the negotiations between the oversight board and the vulture funds.

Thus, a civil war began between the vulture funds.

In reaction to the challenge, the Lawful Constitutional Debt Coalition emerged (the Coalition) in February 2019 . The selection of the group’s name indicated that the debt held by these funds was valid debt, as opposed to the challenged debt held by the other groups. Indeed, the Coalition’s financial disclosure shows that at the time of their formation they had not challenged general obligation bonds.8 In April 2019, in a statement of position reporting its stance, the Coalition endorsed the challenge, placing itself in a favorable position to negotiate.9

Support for the challenge paid off for the Coalition, which reached a first agreement with the oversight board on May 31, 2019.10 The agreement was also signed by the QTCB Noteholders Group.11 This agreement served as the basis for the plan of adjustment filed by the oversight board, which was not to the liking of other investors. Bondholders with challenged debt were offered two options: They could continue the legal battle to demonstrate the validity of their bonds and risk losing everything, or they could receive a much lower payment than the bondholders with unchallenged debt. Unchallenged bonds were offered 64 cents, while challenged bonds were offered between 35 and 45 cents for each dollar – that is, up to 45% less.12

Despite the challenge, two of the vulture fund coalitions continued to buy the bonds that the oversight board challenged in court. In the case of the Ad Hoc Group of Constitutional Debtholders, from its financial disclosure we can infer that, from January 25, 2019 to February 3, 2020, they acquired over $ 1.1 billion in challenged bonds.13 This demonstrates the group’s confidence that the challenge would not be successful.

In the case of the Coalition, four of its members – GoldenTree, Whitebox, Monarch, and Taconic – positioned themselves on both sides of the legal dispute: once they informed the court of their official position in support of the challenge they also began to buy the bonds whose legality they themselves questioned.14

Challenged 2012-2014 General Obligation Bond Acquisitions

| Fund | June 14, 2019 | August 30, 2019 | January 6, 2020 | Increase |

| GoldenTree | $0 | $19,085,000 | $61,385,000 | $61,385,000 |

| Whitebox | $0 | $2,375,000 | $15,205,000 | $15,205,000 |

| Monarch | $0 | $3,395,000 | $26,790,000 | $26,790,000 |

| Taconic | $465,000 | $15,010,000 | $33,948,000 | $33,483,000 |

| Total | $465,000 | $39,865,000 | $137,328,000 | $136,863,000 |

From June 14, 2019, just before the announcement of the first agreement, until January 6, 2020, a day before the earthquake, the Coalition purchased a little less than $137 million in challenged bonds despite informing the court that they supported the challenge of those same bonds.15 On January 8, the Coalition filed its formal challenge in court, questioning the legality of the bonds they had been buying in the previous months.16

We observe a strong correlation between the oversight board’s challenge and the price evolution of the challenged bonds. From January 2019 until the announcement of the first agreement in June 2019, their prices dropped, in the case of 2014 bonds, or increased at a much slower rate than the rest, in the case of 2012 bonds. The following graph shows the prices of three general obligation bonds, two challenged and one unchallenged.17

The general obligation bonds had more or less the same prices until January 2019, when the oversight board filed its challenge. Since then, a gap began to open to the point that, when the first agreement was announced in June 2019, the 2014 bonds were worth more than 20 cents less than some unchallenged bonds. The 2012 bonds suffered the same fate, although their prices remained above those of 2014. In February 2020, when the second agreement was announced, the price difference was still significant.

In other words, by purchasing the challenged bonds, the Coalition not only bought bonds whose legality they themselves questioned in court, but also, compared to the unchallenged bonds, bought them at lower prices.18

In fact, the Coalition’s financial disclosure shows that the period of greatest purchase of challenged bonds was from September 2019 onward, when the oversight board filed its first version of the plan of adjustment. This entire period was characterized by the court-ordered mandatory mediation. On July 24, 2019, in the midst of the national revolt that culminated in the resignation of Governor Ricardo Rosselló, Judge Swain stopped the litigation and ordered mandatory mediation between the parties.19 Originally the mediation was for four months, but then it was extended until February 2020.20

Purchases of challenged bonds by the vulture funds make sense in light of the agreement reached with the oversight board on February 9, 2020. In this second agreement, the oversight board dropped its challenge. If in the first agreement bondholders with challenged debt were offered between 35 and 45 cents, in the new agreement they were offered between 65 and 70 cents for each dollar.21

The good news of the new deal influenced the bond market. As seen in the graph above, if challenged and unchallenged bonds still had a price difference of up to 15 cents in February 2020 , that difference has now, at the time of the publication of this report, been reduced.

Insider trading?

Since the announcement of the second deal on February 9, 2020, there have been several allegations of insider trading.22 The complaints have even reached Congress. In a public hearing, Congressman Jesús ‘Chuy’ García questioned the oversight board’s executive director, Natalie Jaresko, over whether the oversight board was investigating the complaints, as well about the legal consequences for insider trading. Jaresko replied that the oversight board was aware of the allegations but that it was a matter of law enforcement that was beyond the scope of its oversight.23

Insider trading consists of having an advantage over the rest of the market when buying or selling securities using information that is not public, and whose disclosure can influence the value of what is bought or sold, whether it is stocks or bonds.24 In industry parlance, such information is known as material nonpublic information.25

In the case of the bankruptcy of the government of Puerto Rico, there is a close relationship between what happens in court and the value of the bonds in the market. Previously, we saw there was a strong correlation between the oversight board’s challenge and the price difference between challenged and unchallenged bonds.26 In addition, bond prices usually rise after the oversight board announces a new agreement, like in the case of the COFINA agreement. In this sense, confidential negotiations between the oversight board and the vulture funds are a source of material nonpublic information.

One of the complaints filed in court relates the price increase of two series of general obligation bonds in mid-January with the agreement reached (and confidential) between the vulture funds and the oversight board for the same dates.27

In mid-January 2020, as aftershocks from the earthquake that left hundreds of families homeless continued, the oversight board and the vulture funds reached an “agreement in principle” that was formalized in the February 9 agreement. This is mentioned in a report of the mediation team appointed by the court to mediate between the parties to the dispute.28

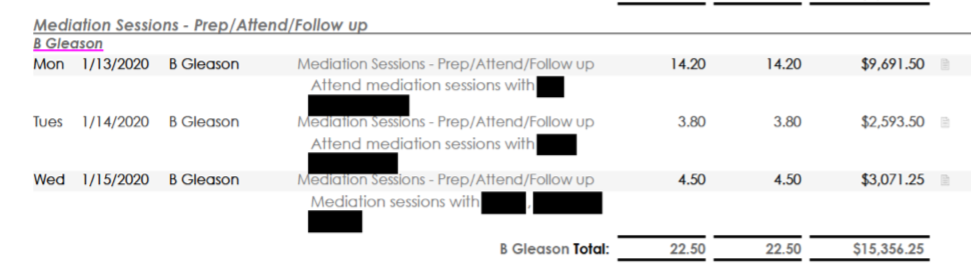

The invoices of Phoenix Management Services, financial advisers to the mediation team, confirm that on January 13, 14 and 15 there were mediation sessions where the Phoenix team was present.29

When examining the evolution of the prices of the two general obligation bonds in question, the 2012A and 2014A series, between January 13, the first day of mediation, and February 8, the day before the signing and announcement of the agreement, the Public Accountability Initiative (PAI) observed that both series increased in price by an average of half a cent per day. However, in the previous weeks, from December 13, 2019 to January 10, 2020, the average price increase of these series was practically insignificant.30 PAI’s analysis of the evolution of prices did not find similar changes in the other general obligation bond series.

In other words, there appears to be a correlation between the price increase of these bonds with the agreement in principle that was reached in the mediating sessions.

The price increase occurred despite the fact that on January 8, 2020 the Coalition reaffirmed its challenge to the 2012-2014 general obligation bonds.31 Just five days after the new agreement was signed and announced, the other vulture funds objected to the challenge.32 Everything seemed to indicate that the civil war between the vultures would continue.

The other allegation considers the price increase of the challenged bonds during the period of compulsory mediation.33 The following table shows different series of general obligation bonds, with their respective identification numbers (CUSIP), the prices they had for July 24, 2019 and for February 8, 2020, the day Judge Swain ordered compulsory mediation and the day before the second agreement was announced, respectively. It also includes the increase and the percentage of increase between both dates.

Prices from July 24, 2019 to February 8, 2020

| Series | CUSIP | July 24, 2019 | Feb. 8, 2020 | Increase | % |

| GO 2014A | 74514LE86 | 54 | 74 | 20 | 37.04% |

| GO 2012A | 74514LB89 | 60 | 75 | 15 | 25.00% |

| GO 2012A | 74514LB71 | 59 | 75 | 16 | 27.12% |

| GO 2012A | 74514LB63 | 60 | 75 | 15 | 25.00% |

| GO 2012B | 74514LZX8 | 51 | 72 | 21 | 41.18% |

| GO 2012B | 74514LZV2 | 50 | 72 | 22 | 44.00% |

| GO 2011C | 74514LXH5 | 67 | 78 | 11 | 16.42% |

| GO 2011E | 74514LZL4 | 67 | 78 | 11 | 16.42% |

| GO 2009C | 74514LWA1 | 70 | 80 | 10 | 14.29% |

| GO 2008A | 74514LVK0 | 72 | 81 | 9 | 12.50% |

| GO 2008A | 74514LVN4 | 70 | 82 | 12 | 17.14% |

| GO 2006A | 74514LKA4 | 71 | 83 | 12 | 16.90% |

| GO 2005A | 74514LPX9 | 72 | 82 | 10 | 13.89% |

| GO 2004A | 74514LPT8 | 68 | 81 | 13 | 19.12% |

In the six months from the mediation order to the day before the announcement of the second agreement, there was no public expression indicating that the challenge would be withdrawn. However, it’s important to note that the prices of the challenged bonds (2012-2014) increased at a faster rate than the unchallenged bonds. The most dramatic case is that of 2014 bonds, which rose 20 cents.

Certainly, with the available public information no definitive conclusions can be drawn that there was inside trading. However, investment patterns and price developments do raise important questions that we believe should be investigated by the relevant authorities.

The new information revealed by the 21 vulture funds helps us better understand the behavior of these firms in the closed-door negotiations to restructure Puerto Rico’s debt. The investment strategies and legal actions of these funds for the past two years show us how the vultures stalk the central government’s general fund, where the budgetary allocations for essential services in the country come from. The plan of adjustment is still under negotiation, so rigorous scrutiny of what both the vulture funds and the oversight board do is necessary.

Endnotes

1 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTU5MDg3&id2=0

2 The financial disclosures also include the bonds of COFINA, the Aqueducts and Sewers Authority, the Electric Power Authority, the Highways and Transportation Authority, the Employees’ Retirement Systems, the Infrastructure Financing Authority and the Convention Center District Authority.

3 The COFINA Senior Bondholders’ Coalition: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=ODk5ODcw&id2=0; in the case of Monarch, its participation was independent through Six PRC Investments LLC: https://www.reuters.com/article/usa-puertorico-bonds/holdout-bondholders-join-puerto-rico-sales-tax-debt-restructuring-idUSL2N1W70V7

4 Amount obtained by adding up the respective classes of claims from the disclosure statement of the second plan of adjustment. See pp. 26-29: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQ0OTAy&id2=0

5 An examination of prices through the Electronic Municipal Market Access.

6 https://cases.primeclerk.com/puertorico/Home-

7 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTAyMTY2&id2=0; The number of challenged bonds eventually increased when bonds from the Public Buildings Authority were included. For a review of all the challenges and lawsuits that followed, see: https://news.littlesis.org/2019/06/05/puerto-ricos-debt-battles-the-oversight-board-goes-on-a-suing-spree/

8 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTY1MTE4&id2=0

9 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTA4NTcy&id2=0

10 https://drive.google.com/file/d/1gpPPd1gnFjvpQ5aY6ZwdeG42dAvzQggz/view

11 The group’s name comes from “qualified tax credit bonds”, whose owners can receive a tax credit from the Federal Treasury. In Puerto Rico these bonds were issued by the Public Buildings Authority to finance the Escuelas del Siglo XXI program. On the other hand, the QTCB Group seems to have had over $252 million in challenged bonds. However, that did not stop them from signing the deal. See: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTY1MDk4&id2=0

12 For an analysis of the first version of the central government’s plan of adjustment, see: https://news.littlesis.org/2019/10/16/a-guide-to-puerto-ricos-debt-adjustment-plan-cuts-for-pensioners-and-payments-on-allegedly-illegal-debt/

13 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTY1MTE0&id2=0

14 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTY1MTE4&id2=0

15 In its financial disclosure, the Coalition includes how many bonds they had as of February 14, 2020. However, we did not include those numbers as the second agreement was signed and publicly announced five days earlier, on February 9. In those five days the funds could have bought previously challenged bonds.

16 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTMyNTU1&id2=0

17 Prices were obtained from EMMA, choosing the first available date of each month. 2014A: https://emma.msrb.org/Security/Details/74514LE86; 2012A: https://emma.msrb.org/Security/Details/AFD79C6F9550611C63E02E2E1402813BE; 2009C: https://emma.msrb.org/Security/Details/74514LWA1

18 Several bond insurers think the Coalition may have promoted the drop in prices of challenged bonds on purpose to buy them cheaper and then reach an agreement with a better repayment. See page 6: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQ3MDUz&id2=0

19 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTE4NDM5&id2=0

20 First extension: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTI0NjQw&id2=0; second extension: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTMwNTMy&id2=0

21 Agreement: https://emma.msrb.org/ES1344275-ES1048205-ES1452453.pdf; summary: https://drive.google.com/file/d/1uyS9_npXsV7cUfMI0cwxENUuc0A5hboG/view

22 See: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQyMjI0&id2=0 and https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQ0OTcz&id2=0

23 The exchange happened at a hearing on PROMESA and its implementation during the COVID-19 pandemic. See 2:35:56: https://www.youtube.com/watch?v=DGaa_voYtDA&feature=emb_logo

24 If an executive knows that their company will merge with another company, and that decision is not yet public, then it is material nonpublic information, since its disclosure would impact the value of the shares of both companies. If the executive leaks that information to an investor to buy the shares before the announcement of the merger, then it would be insider trading, since the investor would have material non-public information that puts them at an advantage over the rest of the market.

25 SEC’s definition of insider trading: https://www.investor.gov/introduction-investing/investing-basics/glossary/insider-trading

26 https://www.reuters.com/article/usa-puertorico-bonds/update-1-puerto-rico-bond-prices-surge-as-restructuring-deals-struck-idUSL1N1V01HV

27 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQyMjI0&id2=0

28 Page 8: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTM5NDIy&id2=0

29 Page 57: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQ3MjEx&id2=0

30 2014A (CUSIP 74514LE86): https://emma.msrb.org/Security/Details/74514LE86; 2012A (CUSIP 74514LB89): https://emma.msrb.org/Security/Details/AFD79C6F9550611C63E02E2E1402813BE

31 The objection was announced through EMMA on February 5, 2020. Objection: https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTMyNTU1&id2=0; EMMA: https://emma.msrb.org/ER1309720-ER1020694-ER1426628.pdf

32 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTM4NTI3&id2=0

33 https://cases.primeclerk.com/puertorico/Home-DownloadPDF?id1=OTQ0OTcz&id2=0