Introduction

The real estate industry is a dominant force in New York State politics. For years, real estate developers have poured millions of dollars into New York elections, taking advantage of the state’s high contribution limits, the highest of any state with contribution limits, and infamous LLC loophole to influence elected officials and ensure that state policy remains friendly to their interests. These peculiarities of New York’s elections laws guarantee that the real estate industry is able to exert much greater influence over what policies elected officials pursue than people who do not have the same access to virtually limitless pools of money and networks of business entities through which to funnel it.

The grossly outsized influence of real estate money on New York elections is particularly clear in years when rent control regulations are set to expire and must be renewed by the legislature. In each year that rent control regulations have been reconsidered by the New York State legislature, developers and landlords have donated several times as much as small individual donors. In each of these years, as the real estate-funded legislature has extended rent control, it has also made critical concessions that have chiseled away at tenant protections and expanded landlords’ ability to hike rents and evict people from their homes.

According to the New York City Rent Guidelines Board, the city incurred a net loss of 142,868 rent-stabilized apartments from 1994 through 2018, with the lion’s share of these losses being attributable to loopholes expanded by the state government.1 In that time, soaring housing costs have left New Yorkers spending more and more of their paychecks on housing, and homelessness has risen to record highs. 2

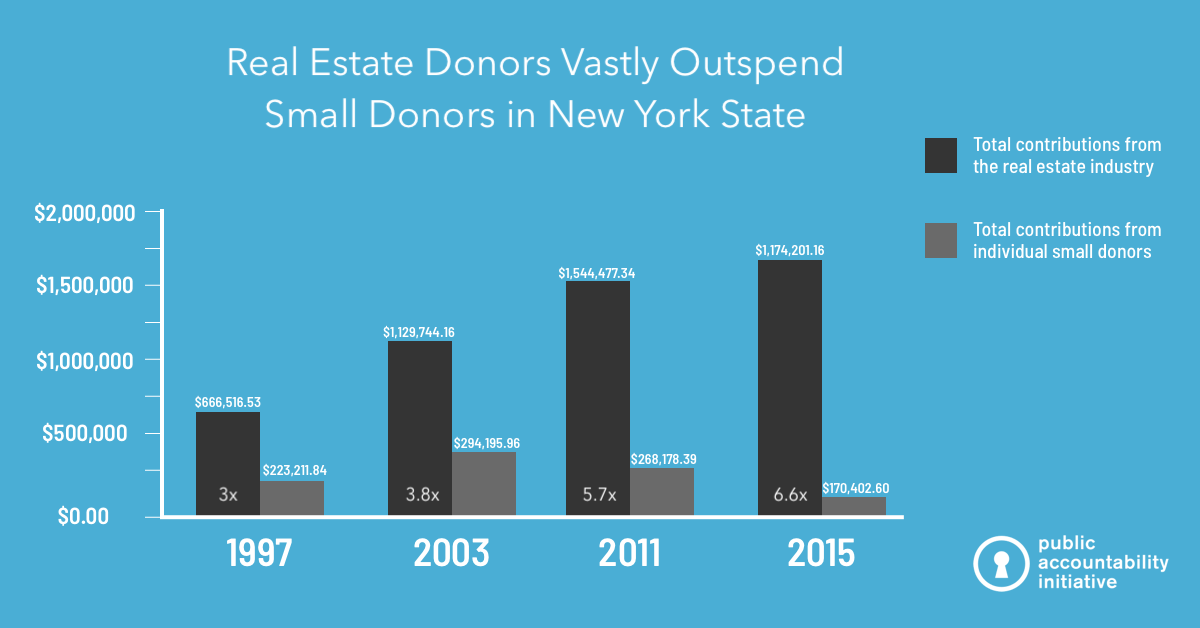

This report examines election spending by individuals and companies from the real estate sector in New York State elections compared to contributions from individual small donors in each of the past five years that rent control laws have been re-adopted. In all of these years, real estate interests have contributed more than all small donors in the state combined, most recently by a factor of nearly seven-to-one.

This year, New York State legislators will decide again on rent control regulations and developers and landlords are surely putting their money to work in Albany. However, politicians and political action committees will not disclose how much money they brought in until July 15, after the legislative session has ended. This means that, while the fate of affordable housing bills will be known by the end of the legislative session, the extent to which real estate interests are outspending small donors will not be known until a full month after the rent regulations are due to expire on June 15.

Data from previous years show the enormous power disparity between real estate interests and average New Yorkers and suggest the need for significant reforms to New York’s campaign finance system.

While some reforms have been adopted already, a statewide system of public campaign finance similar to the one already in effect in New York City would bring about meaningful change in amplifying the impact of small campaign donors and giving everyday New Yorkers a bigger say in Albany to compete with millionaire and billionaire developers and other real estate interests.

Key findings

- In each of the past five years that rent control regulations have expired, political contributions from the real estate industry exceeded contributions from all small donors in New York State by nearly three times to nearly seven times.

- In all of these years, while rent control has been extended for New York City and surrounding counties, the legislature has introduced and extended loopholes that have allowed and incentivized landlords to hike rents, evict tenants, and remove apartments from rent control.

- The majority of New Yorkers are renters, yet under current campaign finance rules, the real estate industry has disproportionate influence. If New York State had a system of public campaign finance structured like New York City’s during these years, this gap would be eliminated due to the public system’s restrictions on corporate contributions, limits on individual contributions, and six-to-one public match of small donations.

Methodology

This report examines contributions to candidates and party committees by small individual donors and the real estate industry using data assembled by the National Institute for Money in Politics (NIMP), showing the outsized influence that real estate interests have in Albany. The data in this report do not include contributions to or spending by independent expenditure committees (also known as Super PACs) or money spent on lobbying – two other avenues through which the real estate industry spends handsomely to advance its political agenda.

Totals for small individual contributions include all itemized contributions from individuals (i.e. not from corporations or other organizations) of less than $175 reported during each year analyzed as well as unitemized contributions from those years. We used $175 as the upper limit for small individual contributions because that is the maximum amount that can be matched in the current public campaign finance proposal being considered by the New York State government.3 Small individual donor totals include unitemized contributions because any unitemized contribution must be less than $99 when aggregated with all other contributions from the same contributor to that recipient.4

Totals for real estate contributions include all itemized contributions coded as being from the real estate industry in the NIMP data set. These contributions include contributions from individuals as well as from corporations, LLCs, and other organizations. It is important to note that these data do not include contributions from individual landlords who have not been coded as belonging to the real estate industry by NIMP. Thus, the total contributions from the real estate industry and landlords is likely much higher than what is reported here.

More information on NIMP’s methodology for coding contributions is available on its Follow the Money website.5

1997

Total contributions from the real estate industry: $666,516.53

Total contributions from individual small donors: $223,211.84

Ratio of real estate money to small donor money: 2.99:1

In 1997, after rent regulations adopted in 1993 expired – leaving New York City and adjacent counties without rent control for four days – the legislature passed the Rent Regulation Reform Act of 1997.6 In addition to establishing a complicated formula for calculating the amount landlords are allowed to hike rents on apartments that become vacant, the 1997 law lowered the threshold for high-rent high-income deregulation from $250,000 per year to $175,000 per year and expanded high-rent vacancy deregulation to include apartments where “rent lawfully reached $2,000 (through the vacancy allowance, improvement allowances etc.) after the prior tenant vacated,” [emphasis added].

The 1997 act also reduced the number of family members who could take over a rent regulated apartment without incurring a rent hike, “eliminat[ing] nieces, nephews, aunts, and uncles from the definition of family members eligible to succeed departing tenants of record.”

The vacancy bonus allows landlords to increase rent by 20% every time an apartment becomes vacant, with other additional increases allowed in some cases.

These loopholes created an incentive for landlords to evict long-time tenants in order to capture vacancy bonuses and move rents towards the threshold for deregulation. By lowering the threshold for high-rent high-income deregulation, the Rent Regulation Reform Act of 1997 also expanded deregulation in suburban counties.

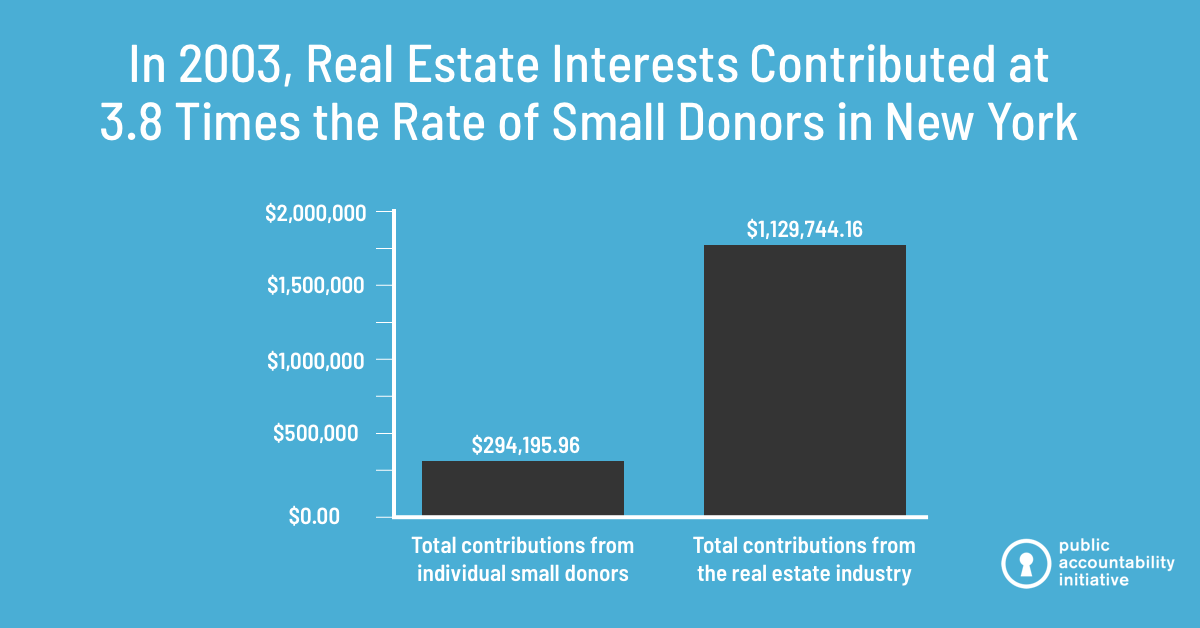

2003

Total contributions from the real estate industry: $1,129,744.16

Total contributions from individual small donors: $292,195.96

Ratio of real estate money to small donor money: 3.84:1

The Rent Law of 2003 chipped away at rent control in three big ways. First, the law formally limited the ability of New York City to pass rent regulation laws on issues controlled by the state. Second, the law allowed apartments to become deregulated upon vacancy if the rent legally could have been raised above $2,000, even if the new tenant in the apartment was not actually being charged more than $2,000. Finally, the law allowed an owner to hike a tenant’s rent in a rent-stabilized apartment up to the maximum legal regulated rent.7

These provisions, together known as the “preferential rent loophole,” allow landlords to dramatically hike rents when many tenants renew their leases, even in excess of New York City Rent Guidelines Board guidelines.

The non-profit journalism organization ProPublica estimated that the Rent Law of 2003 eliminated protections against steep rent hikes for “almost 30 percent of the city’s 860,000 rent-stabilized apartments.”8 Former Attorney General Eric Schneiderman, then a state senator, characterized the loophole as “a declaration of nuclear war on rent-regulated tenants in New York.”

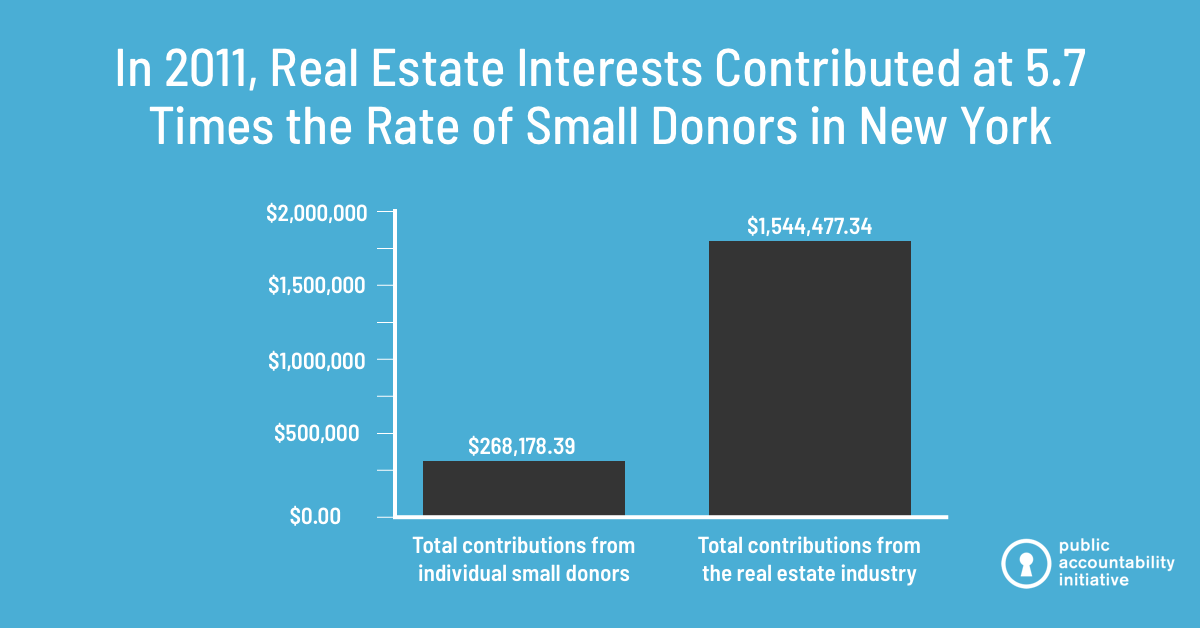

2011

Total contributions from the real estate industry: $1,544,477.34

Total contributions from individual small donors: $268,178.39

Ratio of real estate money to small donor money: 5.76:1

The Rent Act of 2011 raised the thresholds for high-rent, high-income deregulation and high-rent vacancy deregulation from $2,000 per month in rent to $2,500 per month and from $175,000 per year in income to $200,000.9 The act also reduced the rent increase allowed for improvements made to individual apartments in buildings with more than 35 apartments from 1/40th of the cost of the improvement to 1/60th of the cost and limited landlords to hiking rents due to vacancy only one time per year.

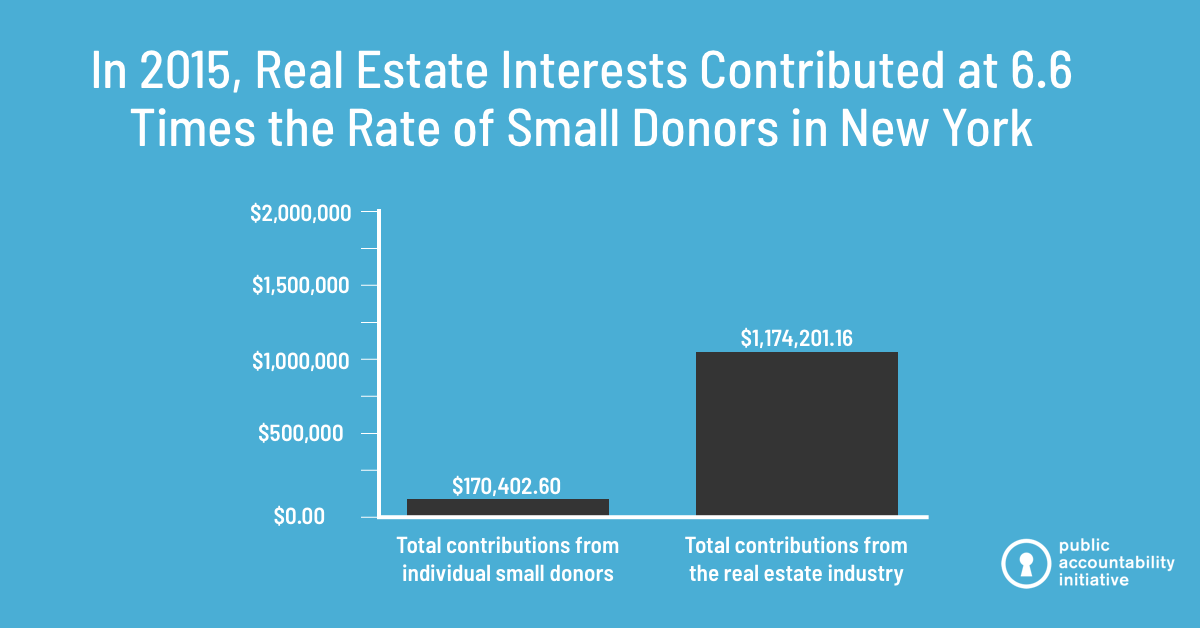

2015

Total contributions from the real estate industry: $1,174,201.16

Total contributions from individual small donors: $170,402.60

Ratio of real estate money to small donor money: 6.60:1

When the Rent Act of 2011 expired, the legislature enacted the Rent Act of 2015.10 This extension of rent regulations increased the threshold for vacancy deregulation up to $2,700 per month and increased the amortization period for major capital improvements (MCIs) from seven years to eight years for buildings with 35 or fewer apartments and nine years for buildings with more than 35 units. The act also somewhat limited how much landlords can hike rents in vacant apartments where the previous tenant was paying a rent less than the legal maximum regulated rent.

While the Rent Acts of 2011 and 2015 represented a marginal push back against the 1997 and 2003 carve-outs, New York City still lost a net 21,796 units of rent-stabilized housing from 2011 through 2018, according to data from the city’s Rent Guidelines Board.11

Out of the total 72,445 stabilized units lost, 71% were lost due to high-rent vacancy deregulation and high-rent high-income deregulation. Further, the Rent Guidelines Board notes: “Prior to 2014, registration of deregulated units with [the New York State Department of Housing and Community Resources] was voluntary. These totals therefore represent a ‘floor’ or minimum count of the actual number of deregulated units in these years.” It is likely, then, that the actual number of apartments removed from rent stabilization, and thus share of rent-stabilized apartments lost due to high-rent vacancy deregulation, was even greater.

2019

Total contributions from individual small donors: ?

Total contributions from the real estate industry: ?

Ratio of real estate money to small donor money: ?

As mentioned above, although the outcome of the current fight over rent regulation will be known by June 15, the amount of money that the real estate industry spent to influence policymakers will not be known until July 15, a full month later. The industry certainly appears to be ready for more of the same this year. According to an analysis by The Real Deal, the Real Estate Board of New York, a powerful landlords lobbying group, has donated more to Democrats in the New York State Assembly since 2018 than any other year on record.12

Further, the trends from previous years in which rent regulations expired are clear: as elected leaders have raised increasing amounts of money from real estate interests and the proportion of money from small individual donors has declined, protections for tenants have been stripped away and housing costs have skyrocketed.

Conclusion

New York’s campaign finance laws – particularly the state’s highest in the nation contribution limits and the LLC loophole – have allowed the state’s powerful real estate industry to have an outsized influence over housing policy. In each of the past four years that state rent regulations (which impact tenants in all five boroughs of New York City as well as the surrounding counties) have expired, real estate interests have outspent all small donors in the state by nearly 3:1 in 1997 to as much as 6.6:1 in 2015. Over that time, more than 100,000 rent-regulated apartments have been deregulated.

A public-financed small donor matching system that matches small individual donations while restricting corporate contributions and lowering individual contribution limits would virtually erase the disparity between landlords’ campaign spending and that of every day New Yorkers.

This report was prepared by Robert Galbraith, senior research analyst at Public Accountability Initiative, and was produced in partnership with Fair Elections for New York and Housing Justice for All.

Endnotes

1 https://www1.nyc.gov/assets/rentguidelinesboard/pdf/changes19.pdf

2 https://www.coalitionforthehomeless.org/wp-content/uploads/2019/04/StateOfThe-Homeless2019.pdf

3 https://www.budget.ny.gov/pubs/archive/fy20/exec/artvii/gger-artvii.pdf

4 https://www.elections.ny.gov/NYSBOE/download/finance/hndbk2019.pdf

5 https://www.followthemoney.org/our-data/about-our-data

6 https://www1.nyc.gov/assets/rentguidelinesboard/pdf/history/historyoftheboard.pdf

7 https://www1.nyc.gov/assets/rentguidelinesboard/pdf/history/historyoftheboard.pdf

8 https://www.propublica.org/article/new-york-landlords-exploit-loophole-to-hike-rents-despite-freeze

9 https://www1.nyc.gov/assets/rentguidelinesboard/pdf/history/historyoftheboard.pdf

10 https://www1.nyc.gov/assets/rentguidelinesboard/pdf/history/historyoftheboard.pdf

11 https://www1.nyc.gov/assets/rentguidelinesboard/pdf/changes19.pdf

12 https://therealdeal.com/2019/06/05/rebny-is-donating-more-than-ever-but-so-are-its-independent-minded-constituents/