For years, an array of think tanks, media outlets, and political leaders in New York State have warned that high taxes will cause wealthy New Yorkers to flee the state or are already causing them to leave.

An analysis of personal income tax data shows that this narrative is grounded not in actual evidence, but in the ideological tendencies of the anti-tax activists that advance it. On the contrary, million-dollar earner numbers have increased substantially at a time of increased tax rates on the wealthy.

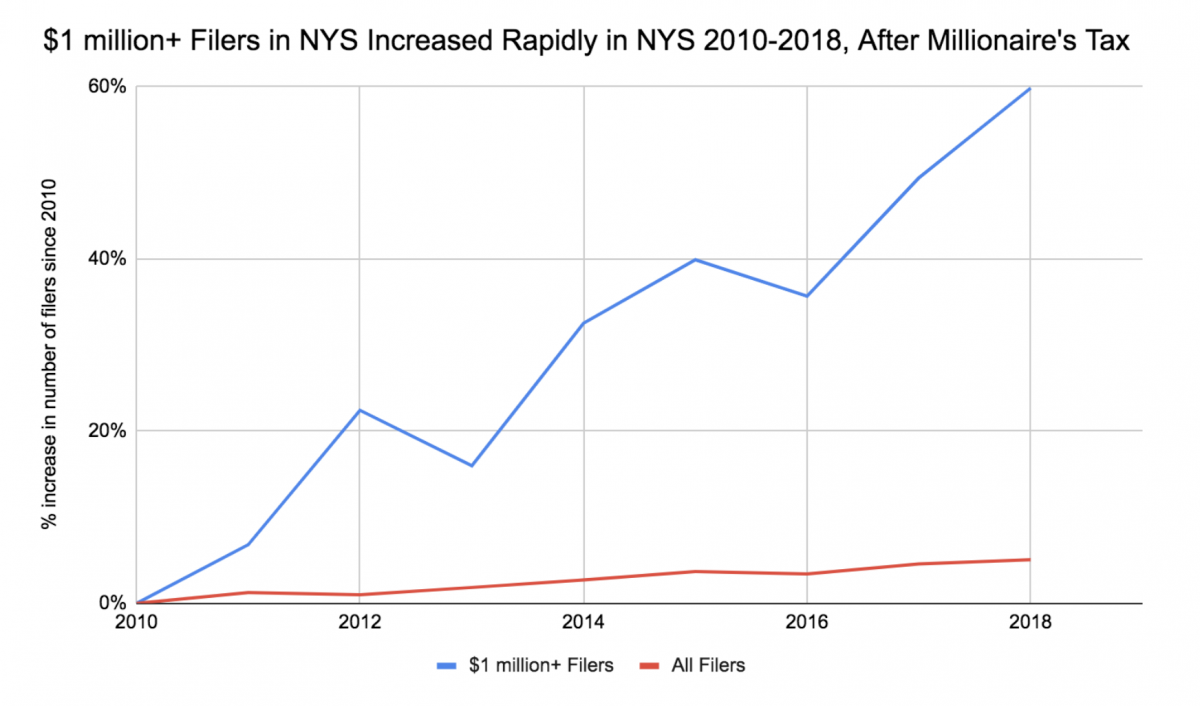

I. Data shows million-dollar earner numbers increased substantially during period of increased tax rates

In 2009, New York State raised taxes on high-income brackets, as part of a “millionaire’s tax”; those rates have largely remained in place for New Yorkers making $1 million or more. At the time, the Manhattan Institute and other anti-tax activists in media and politics warned that this would cause rich people to leave the state.

IRS personal income tax data1 shows that this was not the case:

- From 2010 to 2018 (the most recent year for which data is available), the number of $1 million+ earners in New York State went from 35,802 to 57,210, an increase of 21,408.

- This represented an increase of $1 million+ filers of 59.8%. By contrast, the number of personal income tax filers with New York State residency increased just 5.07% from 2010 to 2018.

The number of $1 million+ filers with residency in New York State increased nearly 60% from 2010 to 2018, in the years after the millionaires tax was imposed. By comparison, the number of all personal income tax filers with residency in New York State was relatively flat, increasing just 5%.

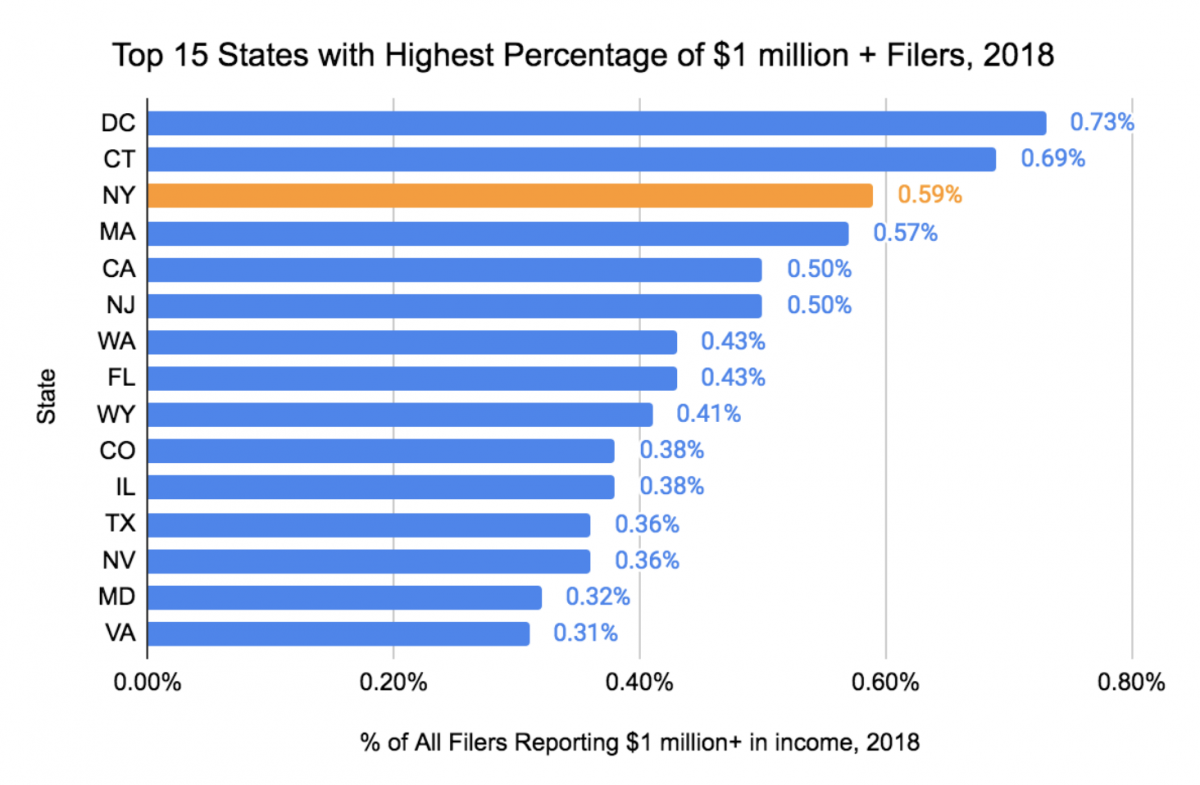

● The percentage of filers in New York State with over $1 million in annual income increased to 0.59% in 2018 – a higher percentage than all other states except Connecticut (and the District of Columbia).

As of 2018, the most recent year for which data is available, the percentage of all personal income tax filers with residency in New York State who make more than $1 million is higher than nearly every state, with the exception of the District of Columbia and Connecticut

II. Data suggests wealthy people not leaving New York State during pandemic

In the course of the pandemic, the argument that the wealthy are leaving New York State has gathered even more steam. Tax payments and housing sales suggest otherwise:

- Estimated tax payments came in high in January 2021, running ahead of pre-pandemic January 2020 numbers by 25%.2 Estimated payments, since they are not based primarily on withholding/wages and more on capital gains and other non-wage income, tend to be a strong indicator of wealthy tax payments. January estimated payments tend to be an indicator of Wall Street bonus compensation.3

- New York State’s median house sales price jumped 11.6% in 2020,4 and sales of $4 million-plus homes in the last quarter of 2020 were above figures for the last quarter of 2019.5

III. Anti-tax activists’ arguments not grounded in data

Anti-tax activists rely on faulty arguments, insubstantial evidence, and weak assumptions to make the case that high tax rates are encouraging the wealthy to leave New York, or not come to New York, and that tax increases will cause an exodus of the wealthy. The following is a summary of core arguments:

- Census and IRS out-migration data:6 Census estimates do indicate population loss in New York State, but for the population as a whole – they do not provide any evidence that the wealthy are fleeing the state. IRS migration data does indicate some net loss in the upper income tiers, but these percentages are low, in the 2% range, and more than made up for by overall increases in $1 million+ earner numbers as high-income earners make even more, and move up into that bracket. In other words, the IRS data indicates that more million dollar earners move out of the state rather than into it, each year, but these numbers are far lower than the overall increases in million dollar earners. Furthermore, IRS migration data is increasingly understood to be flawed and unreliable.7

- State Wealth Growth: Anti-wealthy tax arguments largely ignore and downplay the cases of states like California, where numbers of rich people are growing at a faster rate than most other states, but in a high-tax environment, and through periods of significant state income tax rate increases (the top personal income tax rate is currently 13.3%).

- False causation: They also make unsupported assumptions about causation. For instance, many wealthy people retire to Florida. No serious person would claim that warm weather and luxury retirement infrastructure are not major factors, perhaps primary factors, driving this; studies show that taxes are merely one of many factors that wealthy people consider in choosing their place of residence.8 Yet, many anti-tax activists claim that these decisions are based mainly on taxes, pointing to the anecdotal evidence of high-profile announcements of billionaires leaving for tax reasons.

- High Percentage: They point to other states where the numbers of wealthy filers are increasing more rapidly.9 In doing so, they ignore that New York State has close to the highest percentage of rich people in the country, and the highest of any large state. It makes sense that having reached such a high percentage of wealthy filers, growth would slow somewhat in New York State compared to other states. They also ignore other factors, such as the depth of the housing price collapse in other states, which may contribute to wealthy filer numbers rebounding more significantly.

Endnotes

1 2010-2018 data was compiled and analyzed from IRS data sets by state. “SOI Tax Stats – Historic Table 2,” IRS. Available at: https://www.irs.gov/statistics/soi-tax-stats-historic-table-2

2 New York State Comptroller January 2021 cash basis report, available at:

https://www.osc.state.ny.us/files/reports/finance/cash-basis/pdf/cash-basis-january-2021.pdf

3 Ibid.

4 “2020 Annual Report on the New York State Market,” New York State Association of Realtors, January 21, 2021. Available at: https://www.nysar.com/wp-content/uploads/2021/01/NYSAR_ANN_2020-1.pdf

5 James Tarmy, “New York Luxury Real Estate Could Be a Bargain in 2021,” Bloomberg, December 23, 2020. Available at: https://www.bloomberg.com/news/articles/2020-12-23/new-york-luxury-real-estate-bargains-in-2021-and-other-predictions

6 See, for example, EJ McMahon, “Where are New Yorkers Going?,” Empire Policy Center, January 1, 2020. Available at: https://www.empirecenter.org/publications/wherearenewyorkersgoing/

7 DeWaard et al, “User Beware: Concerning Findings from Recent US Internal Revenue Service Migration Data,” University of Minnesota Minnesota Population Center, April 2020. Available at: https://assets.ipums.org/_files/mpc/wp2020-02.pdf

8 Cristobal Young et al., “Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data,”

American Sociological Review, Vol. 81 No. 3, 2016, https://web.stanford.edu/~cy10/public/Jun16ASRFeature.pdf

9 EJ McMahon, “NY gained fewer millionaire filers than US average in 2010-15,” Empire Center, September 11, 2017. Available at: https://www.empirecenter.org/publications/ny-gained-fewer-millionaire-filers/